Comparison Rate: An Essential Tool When Choosing The Best Lender

Buying a new car is exciting, especially when you imagine picking up the keys and going for that first drive. However, the process of purchasing a car can be overwhelming. You need to consider many factors when selecting a car, such as the price, performance, fuel consumption, safety features, and so on. Then, once you have finally decided on the best car for you and your family, you start the arduous task of finding the best car loan.

With so many car loan options available, it can be confusing for most people. There are endless terms to consider like fees and charges, fixed or variable rates, loan duration – the list goes on! The one term that is often overlooked when purchasing a new or used car is the comparison rate. It is possibly one of the most important rates to examine when choosing a loan, yet many people forget to consider it.

A comparison rate is a powerful tool when choosing the best loan for your next car – let’s find out why!

.jpg)

What is a comparison rate?

Firstly, to learn what a comparison rate is, we need to define what it is not. A comparison rate is not the same as an advertised interest rate. Confusingly, lenders may refer to interest rates and comparison rates interchangeably within a car loan discussion. They are not the same thing.

An interest rate is an amount a lender (or credit provider) will charge you for borrowing the money. It is shown as an annual percentage rate, expressed as p.a. (“per annum”).

So, what exactly is a ‘comparison rate’, and how is this different?

A comparison rate is also expressed as a percentage, but instead, this rate indicates the real cost of a loan. It includes certain fees and charges relating to the loan that lenders will charge you.

The comparison rate is designed to help you understand the overall cost of a loan based on several relevant factors, rather than just the interest rate. That’s why this rate is useful when you're comparing loans from different lenders.

How is a comparison rate calculated?

A comparison rate is calculated in accordance with a standard formula, specified by Australian government regulations, which takes into account the following:

- The amount borrowed

- The term of the loan

- The frequency of loan repayments

- The interest rate

- Most fees and charges

The comparison rate gives you a more accurate idea of the true cost to borrow money for your car, and they are calculated in virtually the same way as home loan comparison rates.

Australian lenders are legally required to show you the comparison rate of each loan so that you can compare loans from other lenders to make an informed decision. Knowing exactly what the comparison rate is and how it works will help you make the right decision for you when purchasing your next car.

While comparison rates take into account almost all fees and charges that are related to a loan, they do exclude things liek stamp duty. They also don’t consider any potential cost saving options such as fee waivers.

Why do comparison rates differ?

When you first start comparing comparison rates, you may be surprised by how varied they are between lenders.

When comparing two car loans, you may notice that one comparison rate is surprisingly higher, despite the loans having the same or lower interest rates. Superficially, it may appear that the loan with a cheaper interest rate would be the best choice, however, when taking into consideration all the additional fees and charges and terms of payment, you may end up paying more over the duration of your car loan.

Bear in mind that different terms, fees or other loan amounts may result in different comparison rates.

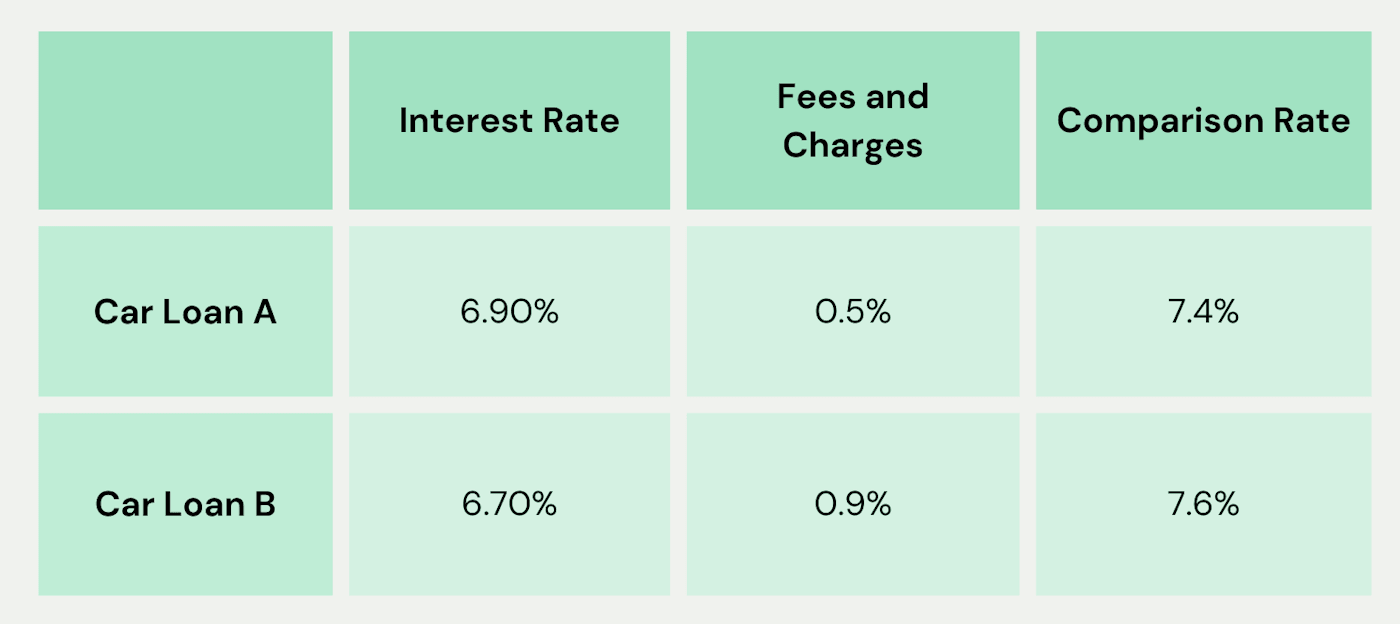

Example of comparison rates

Let’s look at an example.

Car loan A has an interest rate of 6.90%, with fees and charges of 0.5%. Adding these two percentage figures together creates the comparison rate. In this case, the comparison rate is 7.40%.

Car loan B however, has an interest rate of 6.70%, with fees and charges of 0.9%. The comparison rate for this car loan is 7.60%.

In this example, while Car Loan B has a lower interest rate than Car Loan A, its comparison rate is higher than Car Loan A. Car Loan B would ultimately cost the borrower more for the duration of the car loan. This is a perfect example to demonstrate that the loan with the lowest interest rate isn’t always the cheapest option. By paying attention to comparison rates when you’re shopping around, you’ll get a better idea of the actual interest rate of each loan option.

When comparing different car loans, you must compare ‘apples with apples’ so to speak. It is important to ensure that each loan compared has the same loan amount, terms and any extras such as balloon payments otherwise you will not get an accurate understanding of how much each loan will cost you.

How comparison rates affect your car purchases

A comparison rate can help you decide the loan best suited to your budget and long-term financial goals. Knowing exactly how much you will pay for your loan for your next car may impact your final decision when choosing a vehicle. The real costs of your car loan (using the comparison rate) might be surprising. The loan costs may be higher than what you expected and you may need to consider a car within a smaller budget. Alternatively, the unexpected additional loan payments may prompt you to consider purchasing an electric vehicle to save on fuel costs as a way to manage your finances.

If you would like to know how much you could borrow today, you can use our easy car loan calculator. Our monthly repayment estimates are fully inclusive of all lender fees, so no need to worry about hidden surprises. These lender fees could include early repayment fees or ongoing fees like monthly fees.

The comparison rate is a simple (yet powerful) tool to compare loans between lenders. When making your final decision when choosing your lender, it’s also important to compare the other features of the loan to see what best works for you and your current financial situation.

.png)

.jpeg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C800%2C800&w=500&h=500)