How To Improve Your Credit Score - Essential Tips

If you're like most people, you probably don't think about your credit score all that often. However, your credit score is one of the most important numbers in your life. From buying a car to renting an apartment or home, a good credit score can open up new opportunities for you. So, how do you improve your credit score? Before we dive into tips and strategies, let's first understand how credit scores work.

How are credit scores calculated?

Your credit score is determined by your credit reports and credit history. Your credit report includes information about your financial behaviour, such as bill payments and loans. A credit provider, such as a bank or credit card company, reports this information to a credit reporting body. The next time you apply for credit, lenders will access your credit report and use it to calculate your credit score.

What is considered a good credit score?

In Australia, credit scores range from 0 to 1,200. A score above 800 is considered excellent, while a score below 500 is considered a bad credit score. You can check your credit score at any time by requesting a free credit score from the following three credit reporting bodies: Equifax, Experian and Illion. So, whether you're just starting out and have a low score, or you've been struggling lately and your score has taken a hit, it pays to know where you stand and work towards improving it.

What are ways to improve your credit score?

1. Check for errors on your credit report.

Sometimes mistakes can happen and incorrect information may be reported to the credit agencies and you can end up with an erroneous credit file. Request a free credit report and review it thoroughly to ensure all the information is accurate. If you spot any errors, contact the credit reporting agency to have them corrected.

2. Make all bill payments on time.

Your payment history makes up a large portion of your credit score, so it's important to pay bills on time. Consider setting up automatic payments or scheduling reminders for yourself to prevent missed or late payments.

3. Keep balances low on credit cards and other revolving credit.

Your credit balance-to-limit ratio (also known as credit utilisation ratio) is the amount of credit you are using compared to your total available credit and is an important factor in determining your credit score. Aim to keep your balances at 30% or lower of your available credit limit.

4. Limit new credit applications.

Each time you apply for a new line of credit, it may result in a hard inquiry on your credit report and can lower your credit score. Limit new credit applications to only when necessary, such as when comparing loan rates or applying for a mortgage.

5. Use different types of credit responsibly.

In addition to paying bills on time, having a mix of different types of credit (such as personal loans, credit accounts and mortgages) can also positively impact your credit score. Just remember to use them responsibly and make all payments on time.

How can you improve your credit score fast?

Improving your credit rating takes time and effort, but there are steps you can take to speed up the process. One of the most important things is to develop a good payment history. This means making all of your payments on time, every time. Getting organised is half the battle. Consider using automatic payments or setting reminders to ensure you never miss a payment.

If you're carrying a lot of debt, another tactic is to work to consolidate debt and pay off high-interest credit cards or loans. Many people choose to work with credit repair companies or financial professionals to create a plan and tackle their debt. This can not only reduce your debt but also improve your credit utilisation ratio.

Lastly, be cautious about applying for new lines of credit and only do so when necessary. Each application results in a hard inquiry which can lower your score temporarily.

How can you increase your credit score to 800?

As mentioned, 800 is the magic number for an excellent credit rating.

Achieving this may not happen overnight, but by following the tips above and consistently working towards improving your credit habits, you can reach this goal. And once you do, you will find it easier to qualify for loans and potentially secure lower interest rates. So, it's worth the effort!

It's important to remember that maintaining a good credit score is a long-term commitment and requires dedication and discipline. But the payoff in the form of lower interest rates and better financial opportunities is well worth it.

The steps above can help, but they will also require patience and consistency to improve your credit standing over time. Creating and sticking to a budget that sees you paying all bills on time and keeping credit card balances low gives you the best chance of reaching a score of 800 and beyond.

Can my credit score go up 200 points in a month?

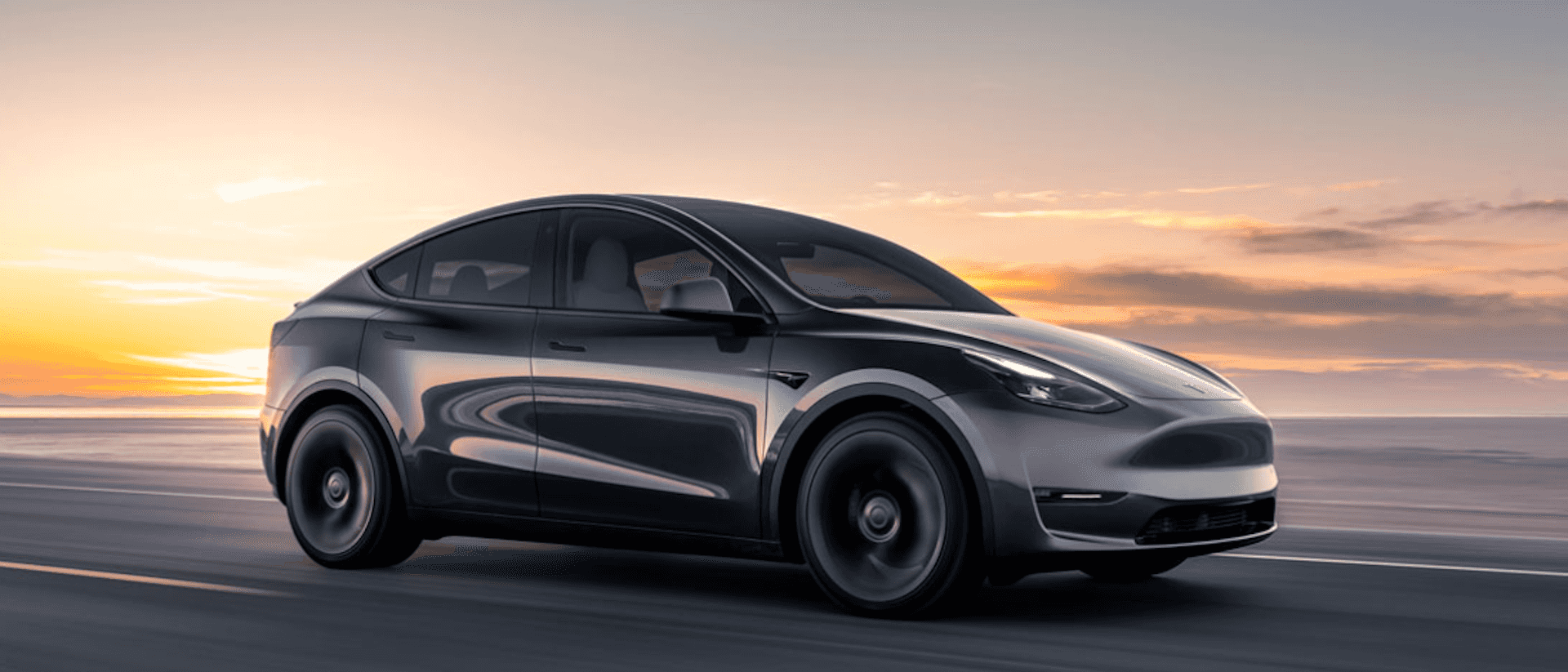

A good credit score is important. It can save you money on loans and help you qualify for new opportunities. For example, if you have a credit score of 720 or higher, you may be able to get a lower interest rate on a car loan. Meaning, you could potentially save thousands of dollars over the life of the loan.

While it's possible for your credit score to go up 200 points in a month, this is not likely without significant changes or efforts on your part. Improving your credit score takes time and patience, but with dedication and smart financial habits, you can see improvements over the course of several months.

So long as you make all payments on time, pay off credit card debt and limit new credit applications, you can work towards a higher score and the benefits it brings. You'll be the proud owner of a terrific credit score before you know it!

Final thoughts

It's important to keep in mind that a credit score is just one factor among many that lenders consider when evaluating your eligibility for loans or other opportunities. So, while it's important to work towards improving your credit score, don't let it become the sole focus of your financial efforts. Instead, focus on overall financial health and developing good habits. For example, if you are thinking of applying for a car loan, using a car finance calculator to calculate the total cost of the loan, including interest, can also help you make a smart financial decision.

Last but certainly not least, it's important to find a great car finance company that not only offers competitive rates but also makes it easy to find the right car loan for your needs.

At Driva, we're on a mission to make the car-buying process as simple and straightforward as possible. We believe that everyone deserves access to great rates, without having to go through a lengthy and complicated process. That's why we've developed our unique intelligent match system. With just a few clicks, you can be matched with the best pre-qualified rates from our network of lenders. And because we only work with reputable lenders, you can be confident that you're getting the best possible deal.

Because we know that your credit score is important to you, we make sure to do all our checks before matching you with lenders. This not only gives you the best chance for approval, but it also avoids any unnecessary credit score dips that can come from multiple credit checks in a short period of time. Only once you’ve chosen your preferred lender quote and submitted your final application will we share your application with your lender of choice. Which is good news for you and your credit score.

.png)

.jpeg?ixlib=gatsbyFP&auto=compress%2Cformat&fit=max&rect=0%2C0%2C800%2C800&w=500&h=500)