Petrol

Bundle your car expenses into one simple payment – all from your pre-tax salary.

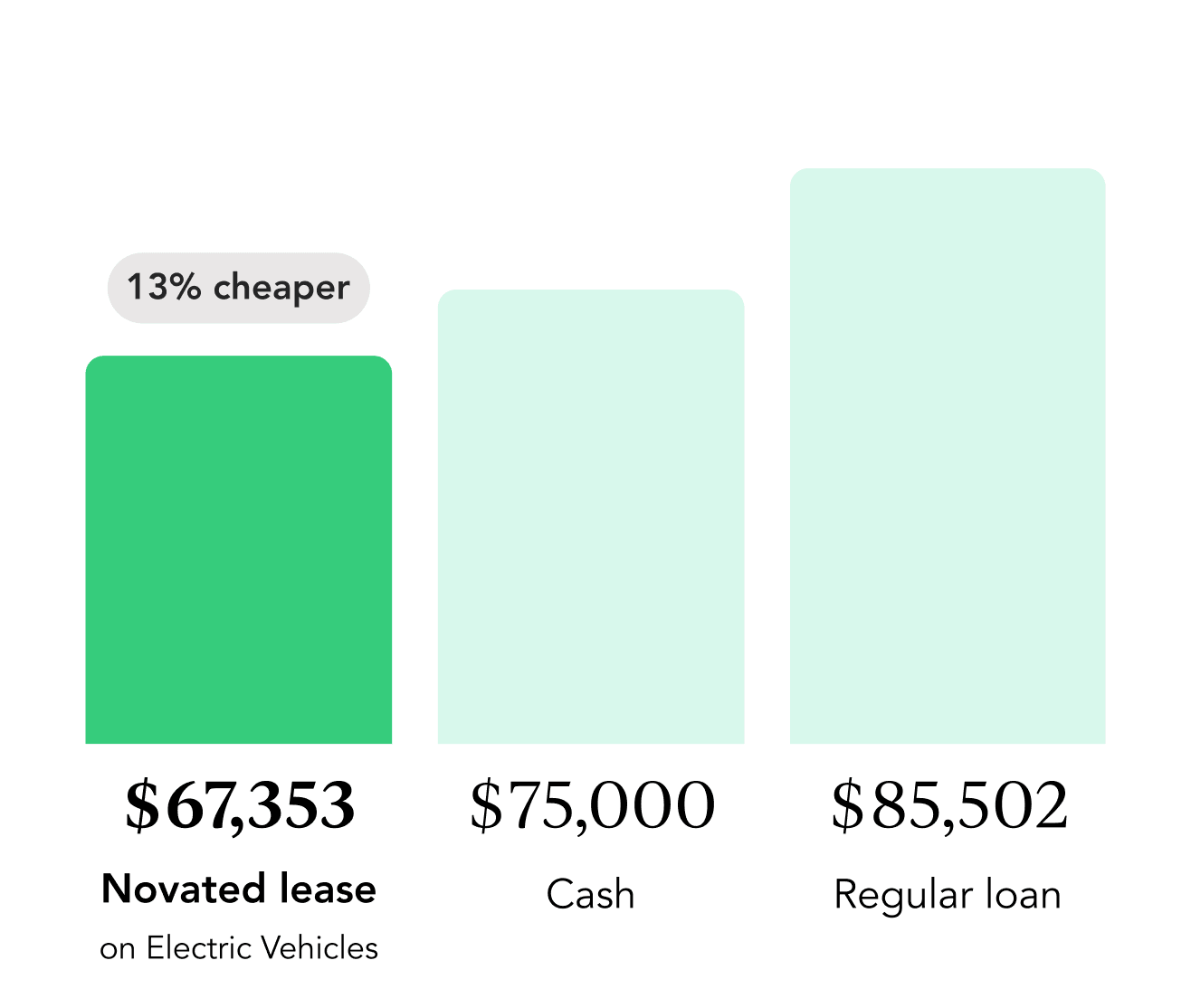

Savings from reduced income tax payable and GST credits available for leases. Includes all interest and lease costs. *Based on $150k salary, 3 year loan term and 7.99% interest rate.

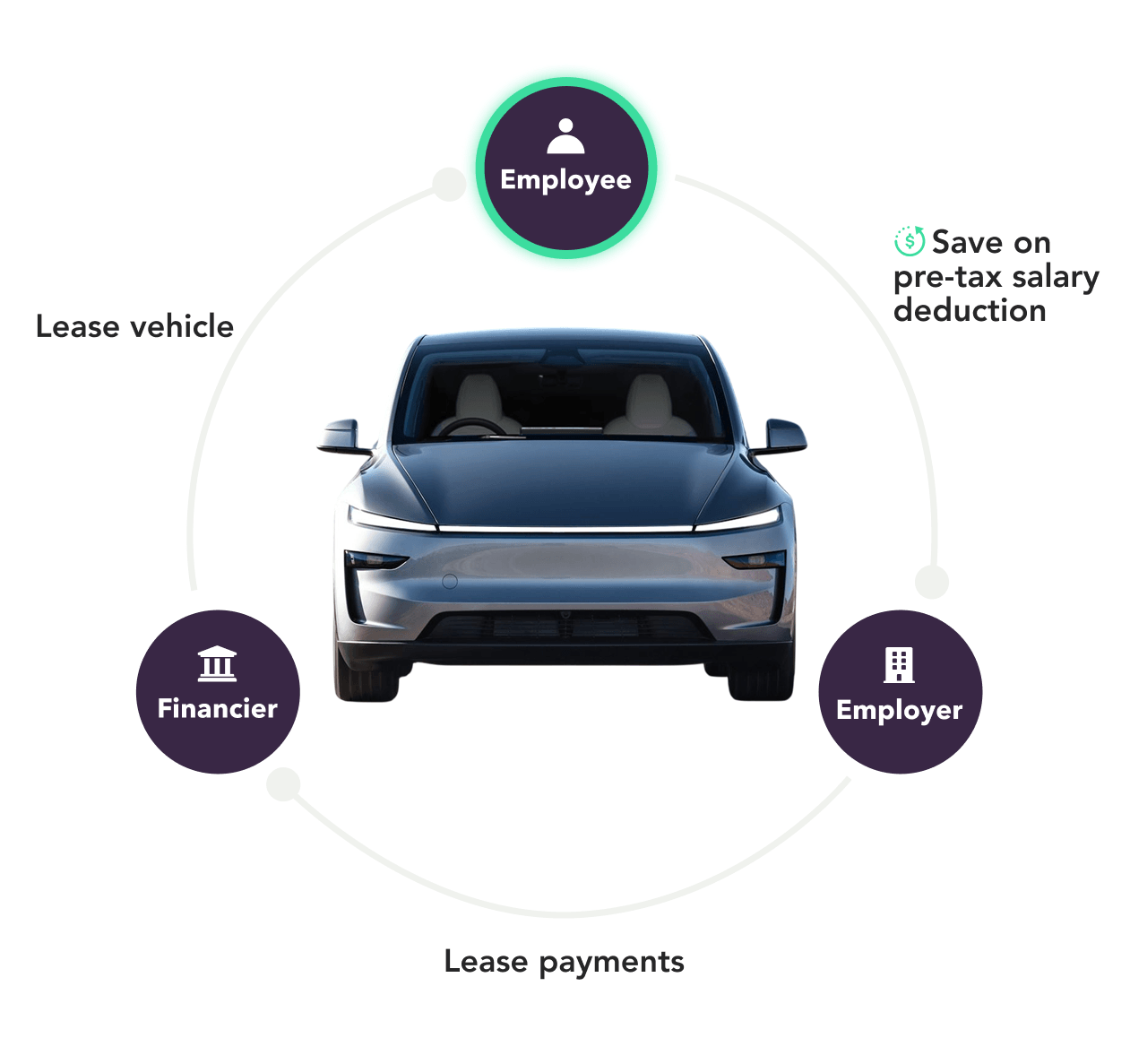

A novated lease is a beneficial salary packaging arrangement that involves an employee, their employer, and a finance company. When you enter a novated leasing contract, you effectively lease a car of your choice – whether it’s a fuel-efficient electric car, a plug-in hybrid, or a traditional petrol vehicle.

The unique aspect of novated leasing is that your employer will make the lease payments on your behalf directly from your pre-tax salary—at no cost to your employer. This arrangement simplifies budgeting by consolidating your vehicle's running costs, including tyre maintenance and other expenses, into one regular payment.

Get a Driva quote

Get an indicative quote of repayments and savings in a few minutes. Quotes are commitment-free and have no impact on your credit score. You can adjust them as many times as you like to compare various vehicles.

Apply online

Once you’ve found your match, complete your application and upload a few documents — it’s quick and easy.

Fast approval

We assess your application for serviceability and match you with the most suitable lender for a fast-tracked approval.

Employer approved

Once your employer gives the green light, we’ll take care of the payroll setup. Your car payments—including running costs—will be automatically deducted from your pre-tax salary each pay cycle. It’s seamless, simple, and tax-effective.

Novated leases can be 10-15% more affordable than paying cash for a vehicle; and up to 30% cheaper than a normal car loan. Not only do you benefit from payments being deducted pre tax; you also pay less GST on the vehicle and with the current government incentives on EVs, you or your employer don’t pay FBT either!

*Savings from reduced income tax payable and GST credits available for leases. Includes all interest and lease costs. Based on $150k salary, 3 year loan term, 7.99% interest rate & $75k vehicle price.

With novated leasing, you can bundle your car repayments and running costs—like fuel, rego, insurance, servicing, and maintenance—into a single payment using your pre-tax salary.

By reducing your taxable income, you pay less tax and boost your take-home pay without compromising on your vehicle choice. Plus, there are no upfront costs, making it easier to get into a new car sooner.

If you choose an eligible electric vehicle (EV) or plug-in hybrid, you could benefit from the Fringe Benefits Tax exemption introduced by the Australian government.

This means you can potentially lease an EV completely FBT-free, saving you thousands compared to a traditional vehicle. It’s an ideal option for eco-conscious drivers looking for a smart, cost-effective way to go green—without the high price tag.

No two drivers are the same, and your novated lease should reflect that. With Driva, you can customise your lease to suit your lifestyle, budget, and driving habits.

Choose your preferred vehicle, set your lease term, and personalise your inclusions. Whether you’re after a practical daily driver or a premium upgrade, Driva gives you full control over how you lease.

We always recommend a second opinion. Read our customer reviews.

Taking the vagueness away from novated leasing.

| Features | Driva | Traditional Leasing |

|---|---|---|

No hidden fees | ||

No hidden fees | ||

Flexible packaging option | ||

Flexible packaging option | ||

Fully digital experience | ||

Fully digital experience | ||

No employer onboarding cost | ||

No employer onboarding cost | ||

No exclusive lock-in contract for your employer | ||

No exclusive lock-in contract for your employer | ||

Drive your dream car and save thousands in tax

Get a personalised quote in minutes — no credit impact, no stress.

Give your employees access to tax-saving novated leases.